Not known Details About Tax Planning copyright

Not known Details About Tax Planning copyright

Blog Article

Facts About Investment Representative Uncovered

Table of ContentsTop Guidelines Of Retirement Planning copyrightGetting The Private Wealth Management copyright To Work5 Easy Facts About Ia Wealth Management ShownWhat Does Private Wealth Management copyright Mean?Some Known Facts About Financial Advisor Victoria Bc.The 9-Minute Rule for Investment Representative

Heath is an advice-only planner, meaning he doesn’t manage his customers’ cash straight, nor really does he offer all of them specific lending options. Heath claims the appeal of this method to him is he does not feel certain to provide a specific product to fix a client’s money issues. If an advisor is only prepared to sell an insurance-based solution to difficulty, they might end up steering some body down an unproductive course during the title of hitting income quotas, he states.“Most economic solutions people in copyright, because they’re paid using the services and products they have market, they're able to have motives to recommend one plan of action over the other,” according to him.“I’ve plumped for this course of motion because i will look my consumers in their eyes rather than feel I’m using them in any way or trying to make a sales pitch.” Story goes on below ad FCAC notes how you spend your own advisor is determined by the service they provide.

The Ultimate Guide To Lighthouse Wealth Management

Heath with his ilk are paid on a fee-only model, therefore they’re compensated like legal counsel may be on a session-by-session basis or a hourly assessment rate (lighthouse wealth management). Depending on the number of services as well as the expertise or common customer base of your own expert or coordinator, hourly charges vary in the hundreds or thousands, Heath says

This is up to $250,000 and above, he states, which boxes out most Canadian families using this degree of service. Story goes on below advertising for the people not able to pay costs for advice-based approaches, and for those not willing to give up some of their investment comes back or without adequate cash to get started with an advisor, you can find less expensive and even cost-free options to consider.

Unknown Facts About Independent Financial Advisor copyright

Story continues below advertising choosing the best financial planner is a bit like matchmaking, Heath claims: You need to find some one who’s reliable, features a personality match and is also just the right person your stage of existence you are really in (https://calendly.com/lighthousewm/30min). Some prefer their advisors is more mature with a bit more experience, he says, although some like some body more youthful who can hopefully stay with all of them from very early decades through your retirement

More About Financial Advisor Victoria Bc

One of the largest mistakes some one make in choosing an advisor is certainly not inquiring enough concerns, Heath claims. He’s surprised as he hears from clients that they’re anxious about inquiring concerns and probably showing up foolish a trend the guy discovers is as common with set up experts and older adults.“I’m shocked, as it’s their cash and they’re having to pay countless charges to these people,” according to him.“You need getting your questions answered while are entitled to for an open and truthful connection.” 6:11 Investment planning all Heath’s last advice can be applied whether you’re finding external economic support or you’re going it alone: educate yourself.

Here are four things to consider and get your self whenever determining whether you really need to touch the knowledge of a financial specialist. The net value isn't your earnings, but rather a quantity that will help you comprehend what money you earn, how much it will save you, and the place you spend money, also.

The smart Trick of Investment Consultant That Nobody is Discussing

Your baby is found on the way in which. Your own divorce case is pending. You’re nearing pension. These along with other significant existence events may remind the need to visit with a monetary expert dig this concerning your assets, debt goals, and various other financial matters. Let’s state your own mommy left you a tidy sum of money within her will.

You might have sketched your own financial plan, but I have a tough time keeping it. A monetary consultant can offer the liability you need to place your monetary plan on track. In addition they may suggest ideas on how to modify the monetary program - https://pblc.me/pub/125e92e301503b being optimize the potential results

The smart Trick of Investment Representative That Nobody is Talking About

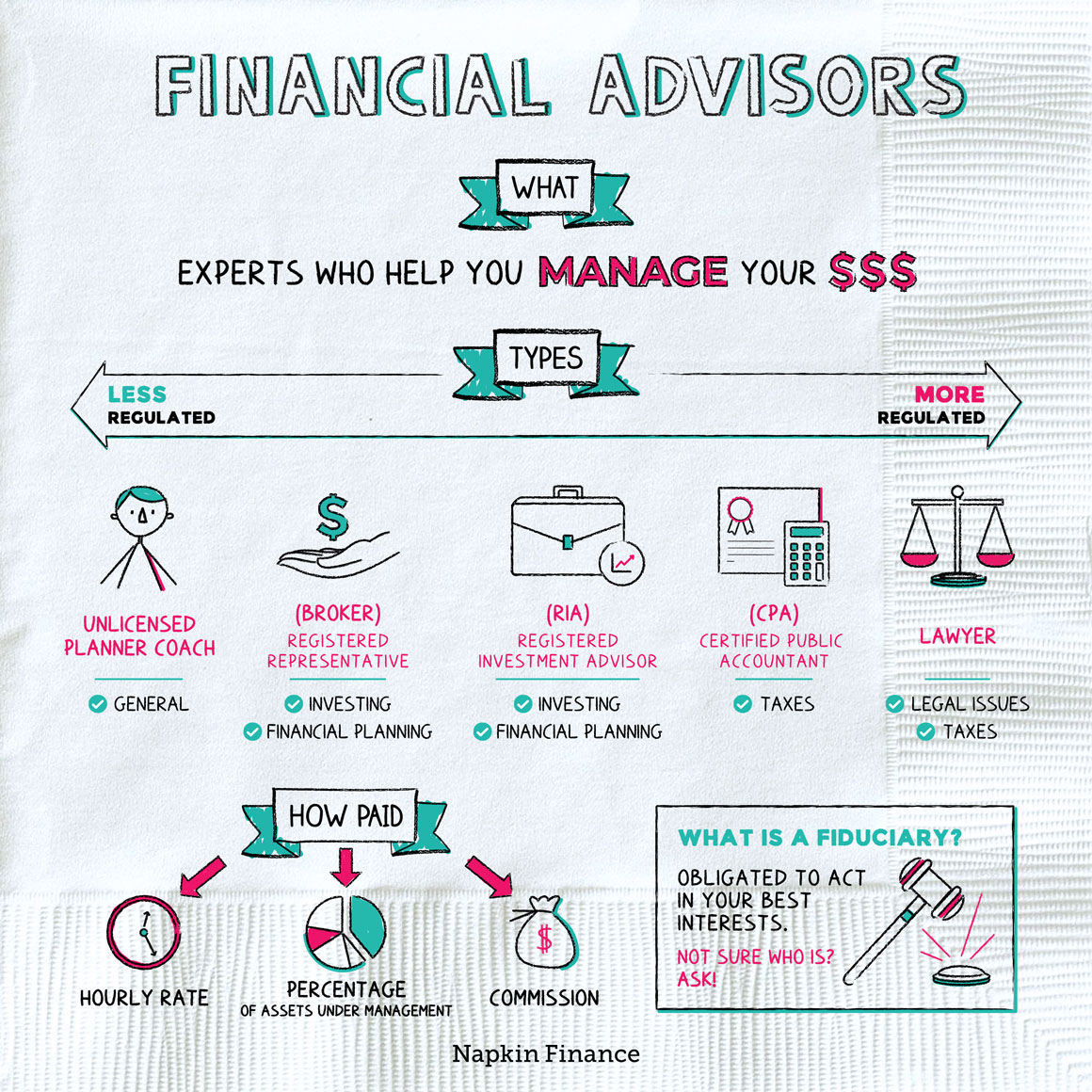

Anybody can state they’re a monetary specialist, but an advisor with expert designations is actually if at all possible usually the one you need to employ. In 2021, approximately 330,300 Americans worked as private financial advisors, based on the U.S. Bureau of Labor Statistics (BLS). Many economic experts are self-employed, the bureau claims - independent investment advisor copyright. Typically, you can find five kinds of economic advisors

Agents typically earn income on investments they make. Agents are managed by the U.S. Securities and Exchange Commission (SEC), the Investment business Regulatory Authority (FINRA) and condition securities regulators. A registered expense expert, either an individual or a firm, is similar to a registered representative. Both trade assets for their clients.

Report this page